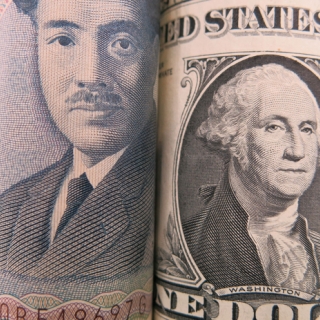

The US dollar (USD) started the week on a positive note, continuing its modest recovery since Thursday, as easing global trade tensions boosted investor sentiment. Interestingly, the greenback, which typically underperforms in a risk-on environment, found support despite improved risk appetite, bolstered by expectations that the Federal Reserve (Fed) will keep interest rates unchanged at its monetary policy decision on Wednesday. Notably, a series of trade agreements concluded last week also provided support for the greenback, with the looming August 1 tariff deadline keeping markets on edge.

The US Dollar Index (DXY), which tracks the greenback against a basket of six major currencies, continued its gains for the third consecutive day, rising nearly 0.50% during American trading hours as markets cheered the breakthrough trade agreement between the United States (US) and the European Union (EU). At the time of writing, the index was hovering around 98.15, marking its highest level in nearly a week.

The new US-EU trade framework agreement was finalized after US President Donald Trump and European Commission President Ursula von der Leyen met briefly at Trump's Turnberry golf course in Scotland on Sunday. Under the agreement, the US will impose 15% tariffs on most EU imports, such as cars, semiconductors, and pharmaceuticals, significantly lower than the previously threatened 30%. According to Reuters, the base tariff will be complemented by "zero-for-zero" tariff exemptions covering strategic sectors including aircraft and parts, certain chemicals, semiconductor manufacturing equipment, generic drugs, agricultural goods, and key raw materials.

In return, the EU has committed to purchasing $250 billion worth of US liquefied natural gas (LNG) annually, totaling about $750 billion over three years. The deal also outlines a $600 billion EU investment package in the US, focused on strategic sectors such as clean energy, defense equipment, and manufacturing. Although the agreement maintains existing 50% tariffs on steel and aluminum, officials have hinted that a quota-based system could replace them in future negotiations. (alg)

Source: FXstreet

The US Dollar found support at the 98.80 area after retreating from the mid-range of the 99.00s on Friday, following Trump's threat to impose 100% tariffs on China. The Index pared losses on Monday bu...

The dollar weakened on Thursday (October 9th), for the first time this week; most G-10 currencies weakened on the day, with the Australian and Canadian dollars outperforming the rest. The Bloomberg D...

The US dollar strengthened on Thursday (October 9th), continuing its gains this week, driven by a weaker euro due to the political crisis in Paris and a weaker yen amid a change in the ruling party le...

The dollar extended its gains for a third day on Wednesday, its longest winning streak since September 19. Most G-10 currencies weakened on the day, with the Canadian dollar outperforming the rest. T...

The dollar continued its strengthening for a second day, pressuring all G-10 currencies; the Japanese yen slumped for a fourth session to its weakest level since March before paring losses. The Bloom...

Silver price (XAG/USD) maintains its position after retreating from a fresh record high of $53.77, currently trading around $52.40 per troy ounce during the European hours on Tuesday. Silver prices climbed as a historic short squeeze in London...

U.S. President Donald Trump remains on track to meet Chinese leader Xi Jinping in South Korea in late October, U.S. Treasury Secretary Scott Bessent said, as both sides looked to ease tensions following fresh tariff threats and export controls. A...

European stocks fell on Tuesday, with the STOXX 50 down 1% and the STOXX 600 down 0.8%, after posting sharp gains in the previous session. The mining, automotive, banking, and industrial sectors led the decline due to renewed concerns over the...

European stocks started the week in positive territory, with the STOXX 50 rising 0.9% and the STOXX 600 adding 0.6%, as traders geared up for the...

European stocks started the week in positive territory, with the STOXX 50 rising 0.9% and the STOXX 600 adding 0.6%, as traders geared up for the...

President Donald Trump's administration on Sunday signaled openness to a trade deal with China, even as tensions escalated over Beijing's new export...

President Donald Trump's administration on Sunday signaled openness to a trade deal with China, even as tensions escalated over Beijing's new export...

Asia-Pacific markets fell Monday after China and the U.S. tightened trade restrictions and traded fresh accusations, renewing tensions between the...

Asia-Pacific markets fell Monday after China and the U.S. tightened trade restrictions and traded fresh accusations, renewing tensions between the...

President Donald Trump arrived in the Egyptian resort of Sharm El-Sheikh on Monday for a summit with several other world leaders aimed at ensuring...

President Donald Trump arrived in the Egyptian resort of Sharm El-Sheikh on Monday for a summit with several other world leaders aimed at ensuring...